What’s at stake in DC?

EarnIn provides working DC residents control over their finances by giving them access to their earnings when needed. But D.C. Attorney General Brian Schwalb wants to upend this innovative new service in the District of Columbia, forcing his own constituents back to traditional credit products that come with mandatory fees, interest, and the recourse to your credit score.

tell D.C. Leaders to Protect your right to Earned Wage Access before it’s too late!

Earned Wage access is not a loan. period.

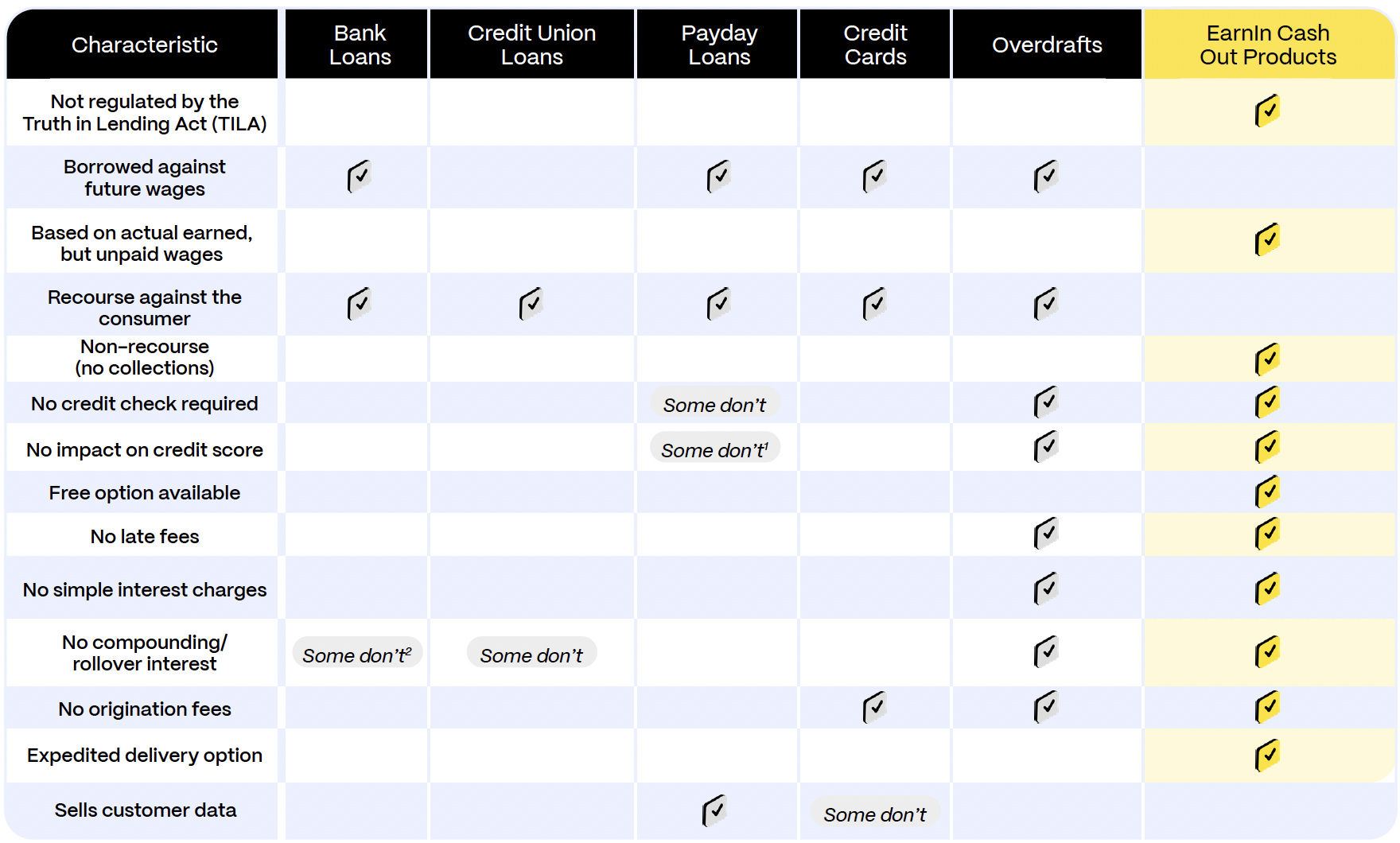

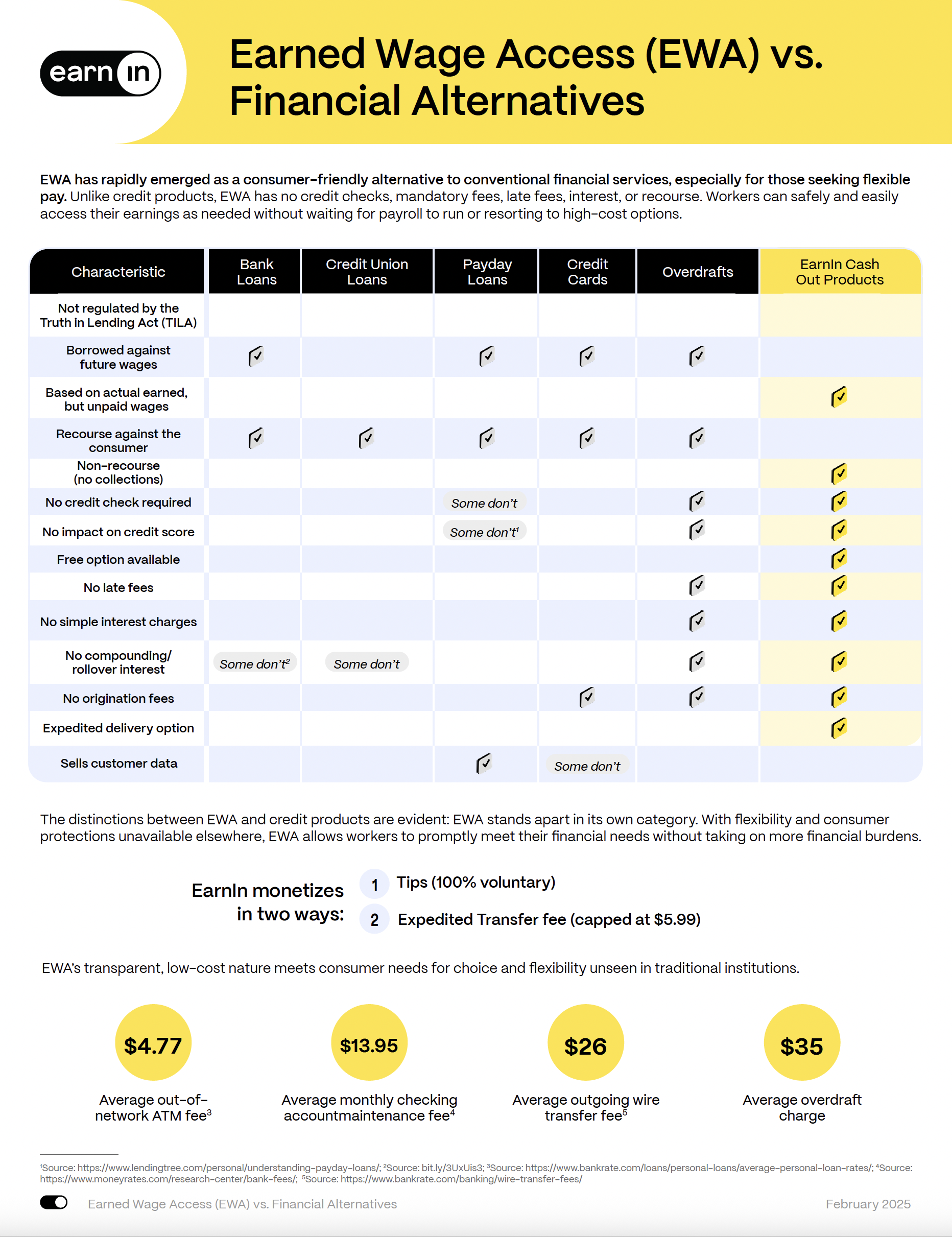

EWA has rapidly emerged as a consumer-friendly alternative to conventional financial service products, especially for those seeking flexible pay. Unlike credit products, EWA has no credit checks, no mandatory fees, no late fees, no interest, and no recourse to credit ratings agencies. Workers can safely and easily access their earnings as needed without waiting for payroll to run or resorting to high-cost options.

But D.C. Attorney General Brian Schwalb continues to falsely call EWA a loan. Here are the key differences between them.

No Interest.

No credit check.

No Impact on your credit score.

Click on image to download.

What benefits are in jeopardy in DC?

*Estimated based on customer account data. Assumptions: Overdraft fee of $35 would be assessed on a negative balance if the customer had not transferred out using EarnIn.

**Research was conducted online by FTI Consulting’s Digital & Insights team, on behalf of Brigit, MoneyLion, and EarnIn. FTI Consulting researched n=4,735 of Brigit, MoneyLion, and EarnIn’s Direct to Consumer (D2C) Earned Wage Access (EWA) service customers between the dates of 4/21/2021 and 5/18/2021, and results were weighted in equal proportions to ensure equal representation among the consumers of each participating company.

Get the Facts About Earnin

Earned Wage Access vs. Traditional Credit Products

Earned Wage Access: Myths and Facts

EarnIn Cash Out Walkthrough

EarnIn Consumer Protections